In the heart of Canada’s vibrant west, Edmonton, Alberta, is not just known for its breathtaking landscapes and robust oil and gas industry; it’s also a burgeoning ground for businesses of all sizes. However, navigating the complexities of business tax accounting in this dynamic environment can be as challenging as the city’s fluctuating temperatures. Business Tax Accounting in Edmonton, AB, serves as the compass for entrepreneurs steering through the fiscal responsibilities and opportunities within this economic landscape.

Understanding the Edmonton Business Climate

Edmonton’s economy is diverse, with burgeoning sectors in technology, health services, and renewable energies complementing its traditional oil and gas foundation. This diversity offers unique opportunities but also poses specific challenges in tax accounting, making it essential for businesses to have a keen understanding of local tax laws and regulations. Business tax accounting in Edmonton, AB, is not just about compliance; it’s about leveraging tax strategies to fuel growth and sustainability.

The Pillars of Business Tax Accounting in Edmonton, AB

To demystify business tax accounting in this region, it’s crucial to focus on several key areas:

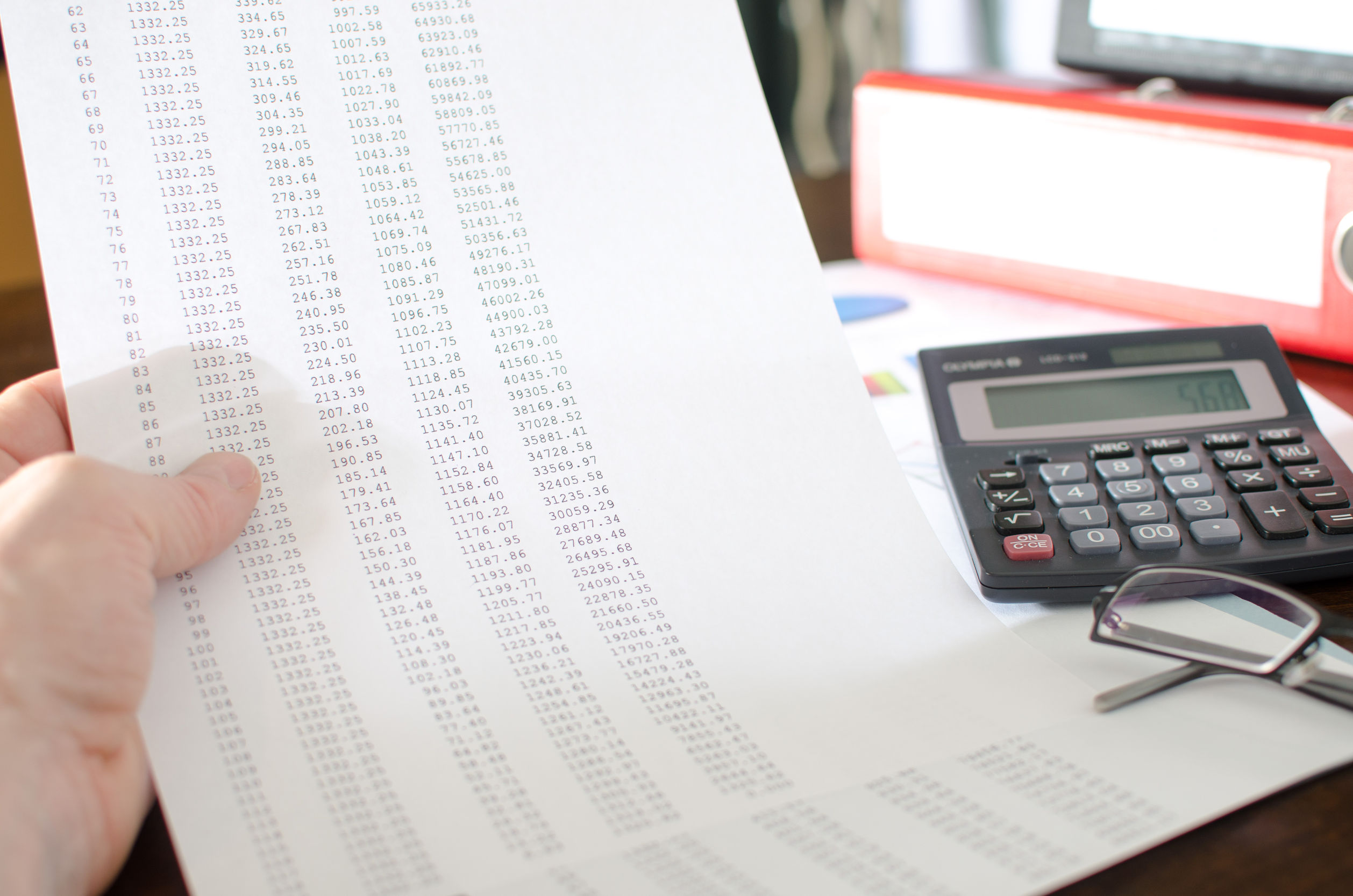

- Tax Compliance and Reporting: Ensuring your business adheres to federal and provincial tax laws is fundamental. This includes accurate and timely filings of corporate tax returns, payroll taxes, and sales taxes. The landscape of tax compliance in Edmonton is continuously evolving, making it imperative for businesses to stay informed and compliant.

- Strategic Tax Planning: Beyond compliance, strategic tax planning can significantly impact a company’s financial health. Understanding the tax incentives, credits, and deductions available to businesses in Edmonton, such as those for research and development or green energy investments, can lead to considerable savings and reinvestment opportunities.

- Navigating Audits and Disputes: Facing the Canada Revenue Agency (CRA) during an audit can be daunting. Expertise in business tax accounting in Edmonton, AB, involves preparing for and navigating through audits efficiently, minimizing disruptions and potential financial repercussions.

- International Taxation: For businesses in Edmonton engaging in international trade or with operations abroad, understanding the implications of international taxation is crucial. This includes transfer pricing, tax treaties, and cross-border tax planning.

Olsen Hahn Accounting: Your Partner in Business Tax Accounting

In the maze of tax regulations and fiscal strategies, having a reliable partner can make all the difference. Olsen Hahn Accounting Ltd stands out as a beacon for businesses in Edmonton, offering a comprehensive suite of tax accounting services tailored to the unique landscape of Alberta’s capital. With a deep understanding of local and federal tax laws, Olsen Hahn Accounting not only ensures compliance but also strategizes to maximize your financial efficiency and growth potential. Their expertise in business tax accounting in Edmonton, AB, positions them as an invaluable ally for businesses looking to navigate the complexities of taxation with confidence and foresight.